Military Debt Consolidation Loans - The debt consolidation process is no different for veterans, but ex-servicemen have access to lending sources that are not available to civilians. These lenders can help you buy a home, lower interest rates on existing debt and pursue higher education. If you're a veteran, it's all available to you.

Before we get into credit card debt consolidation for veterans, let's talk a little about home ownership. If you are a veteran, you are eligible for a VA home equity loan. If you have gone this route and are already in your home, you may be eligible for two other programs that will help you reduce your debt. Check the following:

Military Debt Consolidation Loans

:max_bytes(150000):strip_icc()/DebitCons_Elenathewise-92e8848a79f6446dac1e72b7fc3b7a56.jpg)

The IRRRL program is offered by the Department of Veterans Affairs as an opportunity for veterans to refinance their existing VA home loan to receive a lower interest rate. This action is not classified as consolidation, but it is a good first step before running a debt consolidation calculator to find out how much you can pay in monthly payments.

Military Student Loan Forgiveness: Know Your Options

This is the third piece of the puzzle for veteran homeowners. If you purchased a home with a VA loan, you are eligible for a Military Debt Consolidation Loan (MDCL). This type of loan is secured by your home equity, so make sure you understand the terms and conditions before agreeing to it. It is available exclusively to veterans.

With the exception of the various loan and grant options available to you, debt consolidation works for veterans just like it does for everyone else. Your main goal is to consolidate your credit card debt into one lump sum loan, hoping to lower your interest rate while doing it. The first step in this process is to add up all outstanding credit card balances.

While doing the math, check the interest rates (APR) on each of your credit cards. Most personal loans or VA-backed loans offer lower interest rates than credit cards, but some of your cards may have low or even zero interest. If so, consolidation may not be the right choice for you. Consider refinancing your credit card instead.

If the VA options listed above don't work for you, check with your local bank or search for "debt consolidation loans" online. They can usually be found at any lender that offers personal loans, which are usually unsecured, so you need to have at least a decent credit score. Most lenders prefer scores of 650 or higher, but you can get approved if you have 600.

Ultimate Guide To Consolidating Your Debt

Eliminating credit card debt is a liberating experience, but debt consolidation can be dangerous if you're not careful. Some lenders charge directly from your card, so you never see the money. It is good. Others can deposit the full amount into your bank account, leaving you to pay off the cards yourself. Be sure to do this right away before spending any money.

The last step is self-discipline. Once your credit cards are paid off, you'll have plenty of purchasing power again. Many people, both veterans and non-veterans, are starting to use these cards again. Don't do this. Pay off your debt consolidation loan first before using your credit cards. While this is happening, get used to paying cash again. This is how you get out of debt.

Yes, there are special loans for veterans. The Department of Veterans Affairs can connect you with lenders for VA home equity loans, downgrade loans to refinance your mortgage, and military debt consolidation loans to consolidate credit card debt.

Yes, active duty military personnel are protected by the Servicemen's Civilian Relief Act, which protects interest rates, and the Military Loan Act. There are also several loan options for veterans, including VA home loans and military debt consolidation loans.

Debt Consolidation: Award Winning Nonprofit Program

By using this website, you agree to the use of cookies to collect certain information about your browsing session, to optimize the functionality of the site, for analytical purposes and to serve advertisements through third parties. For more information, see our Privacy Policy. Americans have debt problems and military personnel are uninsured. Many veterans and military personnel have high interest rates on credit cards and short-term loans. In 2017, 44% of all military personnel used a payday loan at least once. Debt consolidation is an option for many people in high-interest debt, but military debt consolidation loans offer veterans and service members an option not available to civilians and non-veterans.

Military personnel have financial protections that civilians do not. The War Loans Act limits the interest rates lenders can charge you, and the Military Civilian Relief Act protects against many foreclosures and repossessions. Understanding the options available to you as a military member makes managing your finances easier. One such option is military debt consolidation loans.

If you are on active duty in serious financial trouble, please get help. Chief financial officers are available to assist you, and many units offer family support centers that can provide one-on-one counselling. Basic banks and credit unions offer many options. There's nothing wrong with admitting you have a problem and asking for help to solve it!

Disclaimer: Credit Summit may be affiliated with some of the companies mentioned in this article. Credit Summit may earn money from advertising or when you contact a business through our platform.

Best Personal Loans For Bad Credit

Military debt consolidation loans are also known as VA consolidation loans. They are available to active duty military and veterans who own homes purchased with VA loans and have equity in those homes. If you do not own a home or have not yet built equity in your home, you will need to use another method of debt relief.

A VA Consolidation Loan is secured against your home, which means it will usually have a lower interest rate. You'll take out one loan, use it to pay off existing debt, and then pay off the new loan in one convenient monthly payment.

A military debt consolidation loan is a type of cash-out refinancing. You will take out a new mortgage for more than you owe on your old mortgage. You will pay off your old mortgage and use the loan balance to pay off old high interest debt. You will not be able to borrow more than the appraised value of your home.

If your home's assessed value is $250,000 and your mortgage balance is $150,000, you have $100,000 in your home. You can get a new $200,000 military debt consolidation loan, pay off the old mortgage, and have $50,000 (minus closing costs) left over for debt consolidation. The mortgage repayment period will be extended.

Best Personal Loans For Debt Consolidation Of January 2023

Equity is based on the current appraised value of your home, not what you paid for it. Home values have skyrocketed in many areas in recent years, leaving many homeowners with more equity than they realize.

A military debt consolidation loan will only help you if you can control the use of the loan. If you keep up with credit card debt, you'll be paying off your debt consolidation loan and new debt, and you'll be no better off.

VA regulations limit the closing costs of VA-guaranteed loans, but you will still face some costs. Remember to compare offers from different lenders to get the lowest fees.

VA lenders may charge an origination fee of up to 1% of the loan amount. The opening commission covers the costs associated with processing the loan. Some lenders charge the full 1%, others may charge less. Some lenders may not charge an exit fee.

Six Things You Should Know About Qualifying For A Va Loan

If your lender charges an origination fee, it is not allowed to charge any underwriting or processing fees, mortgage broker fees, escrow fees, or other fees for loan processing services. They should be included in the creation commission.

The VA charges a financing fee to cover the cost of VA loans to the government. You may be exempt from the finance charge under certain conditions.

Military debt consolidation loans serve a relatively limited number of people. If you do not own a home or have not yet built equity in your home, you will need to consider other debt consolidation options.

The Servicemembers Civilian Relief Act (SCRA) provides a wide range of protections for active duty military personnel. Lenders will have to lower interest rates on pre-service obligations, including credit cards and loans, by up to 6% if you can prove that your services have had a significant impact on your ability to pay.

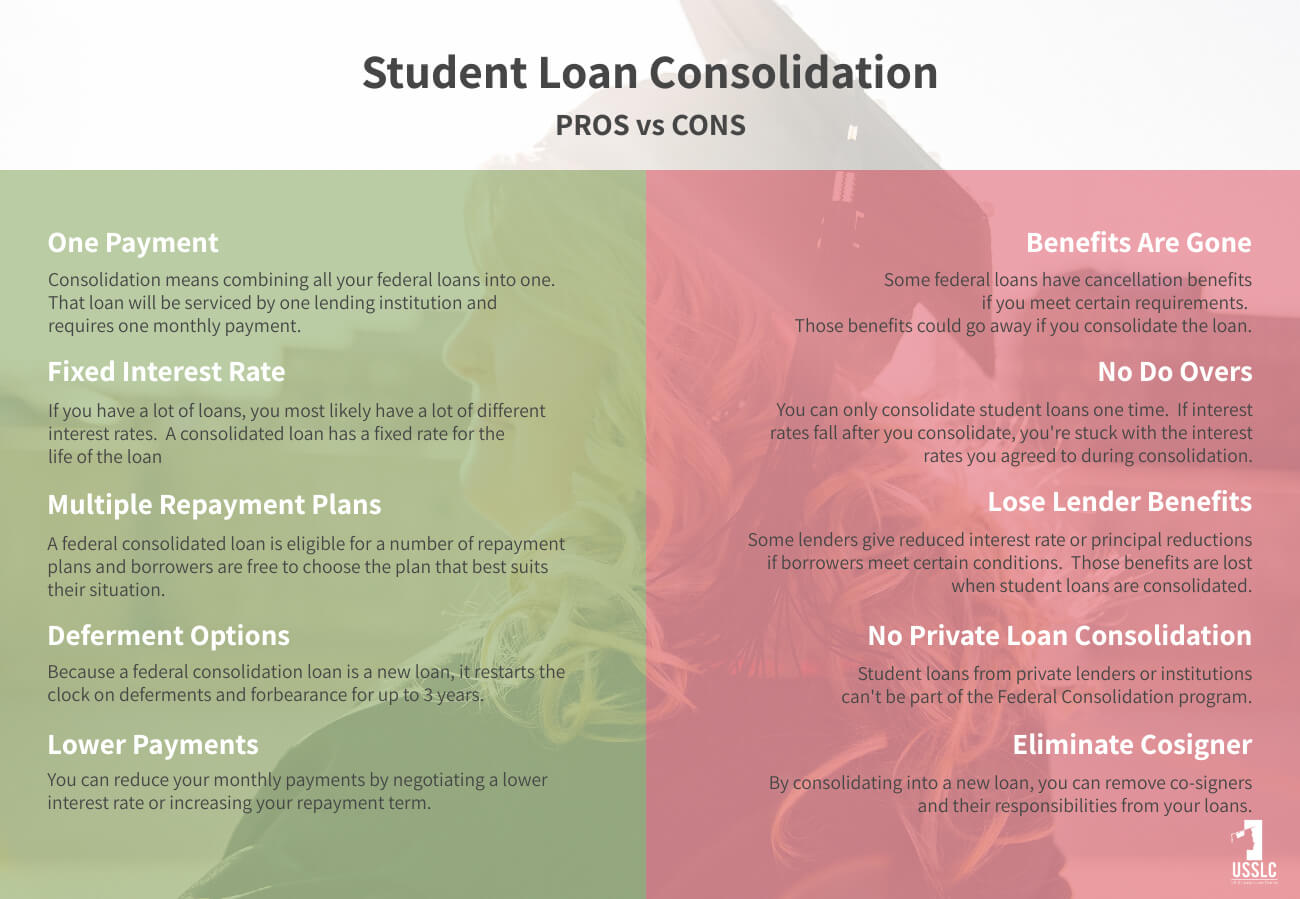

Consolidating Debts: Pros And Cons To Keep In Mind

You will normally need to apply for these benefits. Some credit card issuers extend them automatically. If you can reduce the interest rates on some of your obligations, you may not need to consolidate them.

If you are in debt and at risk of bankruptcy, debt settlement is a possible solution. A debt settlement company will negotiate with your creditors and try to get them to reduce the total amount you owe. This may include stopping payments to certain creditors

Free debt consolidation loans, top debt consolidation loans, easiest debt consolidation loans, debt consolidation loans alberta, rocket loans debt consolidation, debt consolidation loans reviews, easy debt consolidation loans, personal debt consolidation loans, small debt consolidation loans, business debt consolidation loans, debt consolidation loans ontario, online debt consolidation loans

0 Comments