Military Debt Relief Act - More and more at GetOutOfDebt.org, we get questions about how to get your student loans forgiven, forgiven, or discharged once you put them in or service them.

It is absurdly ironic that members of the can go down the path of evil, fight the battle, and not have returned home only to fight to escape the invisible slave of student loan debt.

Military Debt Relief Act

However, there are some real options that can help you do this, but as in, there are rules to follow and hoops to jump through.

Cancelled Or Postponed Military Deployment

One program that has been overlooked is the Utility Loan Forgiveness Program. In this program, members who have been employed or qualified for public service within the past 10 years can have their federal student loans FULLY discharged.

** General health (includes nurses, nurse practitioners, nurses in clinical settings and full-time professionals involved in health professional and health support work)

You must work in the position at least full-time, which is considered to be at least 30 hours per week or which the employer considers to be full-time.

The advantage of this program is that it allows you to release the debt after consolidation with low payments. You can use our online student loan consolidation calculator here.

Why The Amex Platinum Is A Great Card For Active Duty Military

The way the program works is that after you make 120 combined, reduced and on-time monthly payments, your balance will be forgiven.

Not all student loans are eligible for consolidation. Private student loans are not included. Loans eligible for consolidation can be found here.

** Any other Direct Loan Repayment Plan, but only payments at least equal to the amount of monthly payments due under the Standard Repayment Plan with a 10-year repayment period may count toward the 120 monthly payments required. (February 3, 2010)

And you may be able to have loan payments from zero dollars up to 120 required payments. If you qualify for zero monthly payments under the Income Repayment or Income Contingent Payment program, the payment or lack thereof will count. That's great, isn't it?

Biden's Student Loan Forgiveness Plan Survives Two Legal Challenges

Federal law (34 CFR 674.59) states that service in a location that qualifies members for hostile fire or near-danger pay may be eligible for up to 50 percent of the loan canceled if the service is completed before August 14, 2008. For those whose service began on or after that date, they can have up to 100 percent of their loan forgiven.

This is only for Federal Perkins loans. Under federal law, authorization for schools to make new Perkins loans ends on September 30, 2017. But if you have an old loan, it's worth checking. Perkins loans are usually provided by schools rather than banks.

Schools must repay up to 100% of the outstanding balance of their Perkins loan within one year of active duty. The loan commanding officer must certify the borrower's date of service. Active duty service of less than one full year or a fraction of a year beyond a full year does not qualify. A full year of service is 12 consecutive months.

, a site that offers free debt consolidation help and debt relief advice to people looking for answers.

Bamc Launches Initiatives To Help Alleviate Billing Concerns > Joint Base San Antonio > News

Whether you're trying to balance your budget, build credit, choose a good life insurance program, or prepare to buy a home, we've got you covered. Subscribe and get the latest benefits updates and tips straight to your inbox.

Credit.com contributor Steve Rhode is a respected consumer debt expert who helps people for free by providing tips and advice on how to get out of debt through his site at GetOutOfDebt.org. For the right person, in the right situation, a loan can be the right solution. When it comes to getting out of debt, the real skill comes in matching the right solution to the individual's situation and goals.

Top 3 VA Loan Myths That Keep Service Members Using VA Benefits Loans are designed to make the dream of home ownership possible for veterans and current service members, but many don't. ..

5 tips to improve finances during savings month April is savings month, a time to encourage all municipalities to save for the future and achieve...

Debt Consolidation For Veterans: Your Options In 2023

5 Questions to Ask Before Buying a Home Making mistakes when buying a home can jeopardize your flexibility and financial health, and the stakes keep getting higher. Consult...

The "widows tax" for survivors will be abolished from 1 February. Surviving spouses of retirees receiving income from two separate benefit programs will not have a financial crisis, especially early in their careers when their wages may be lower. end of the salary scale. Financial challenges, such as out-of-pocket costs for each permanent station change, can run into the thousands and add to the financial strain.

Sensing an opportunity, some lenders in the last decade took advantage. They targeted the military population with predatory loans with punishing interest rates, fees and terms.

To address these issues, the federal government created the Military Loans Act to regulate what lenders can and cannot do when working with service members and their dependents. Over time, the law has been revised to add more protections, reduce the amount lenders can charge, and limit practices that put service members and their families at risk.

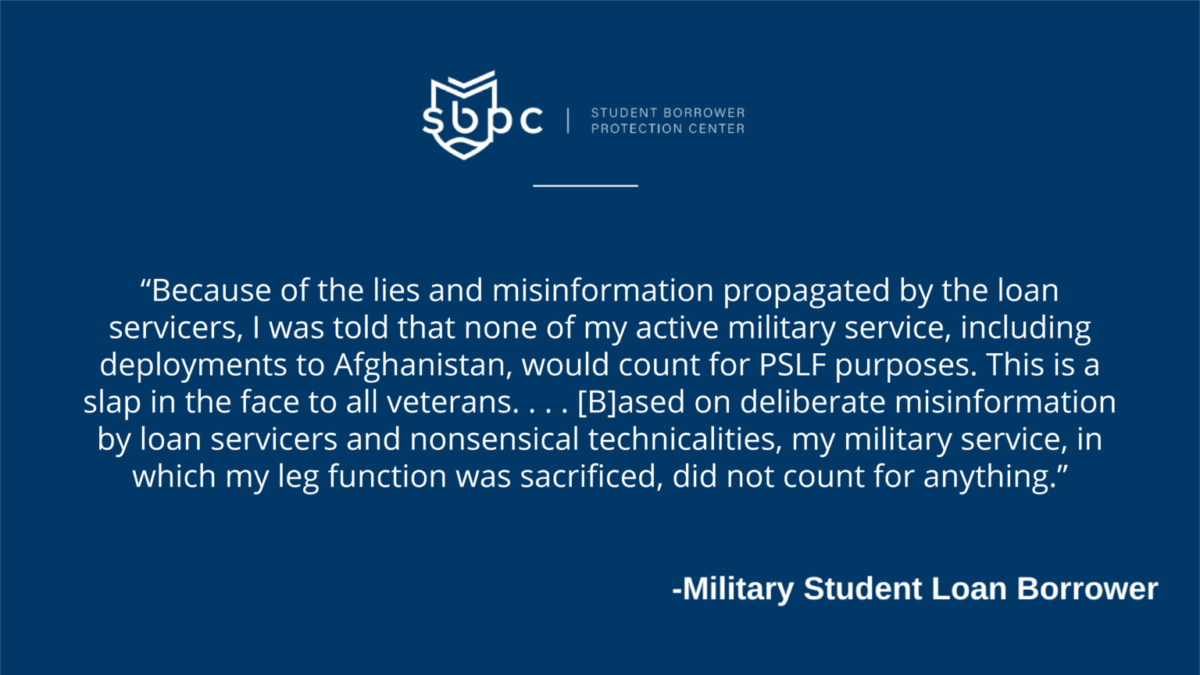

Military Borrowers Continue To Face Obstacles To Getting Their Student Loans Forgiven

First enacted in 2006, the Military Loans Act (MLA) was enacted to protect service members and their spouses, children and other eligible dependents from predatory consumer lending. Over time, it has been revised and expanded to include additional protections, most recently by including credit cards under its umbrella.

One of the main protections in the law is to cap the interest rate on consumer loans at 36%, including fees and charges. The MLA also prohibits lenders from attaching certain conditions to military loans, such as prepayment penalties, renewals or multiple renewals, mandatory terms and mandatory arbitration clauses, as well as removing certain rights that are part of the civilian assistance of service members.

Some lenders still find ways to enforce the rules, so in 2015, the Department of Defense amended the MLA to expand and add protections to a variety of lending and credit products, including some predatory lending. The overhaul also required lenders to provide additional disclosures to borrowers, and starting in 2017, the MLA began covering credit cards.

The MLA only provides protection to the military community for certain types of loans and forms of credit. These now include:

Soldiers Helping Soldiers Fort Rucker Army Emergency Relief Awareness Campaign Under Way

The MLA does not cover secured loans, such as mortgages where the home is collateral. Unsecured loans under MLA include:

Note that the MLA only applies to financial products for personal use; loans for business or commercial purposes are not covered by MLA protection.

The MLA extends protection to all active duty members as well as Reserve members when they are activated for 30 days or more.

The law also protects eligible spouses and certain dependents, such as children. For eligible dependents, they must be enrolled in the Defense Enrollment Eligibility Reporting System (DEERS).

Biden To Allow Most Of Veterans' Medical Debt To Go Unreported

It is up to the creditor or lender to identify whether the borrower is covered by the MLA. Under the latest revisions to the MLA, creditors have access to a database that can provide information about whether a consumer is on active duty or a family member of an active duty member, according to Military OneSource. If you think you've been wrongly denied MLA protection, ask your lender about how to challenge the decision or file a complaint with the Consumer Financial Protection Bureau.

Financial health can be difficult to maintain for anyone, but especially for military personnel. Moving is expensive, and if it's frequent, it can be difficult for a couple to keep a steady job. It can be easy to fall into the trap when you rely on credit and loans, but the MLA helps make sure you don't get hit by predators who make matters worse.

Even with protection, you could still be stuck with expensive debt – 36% is an expensive interest rate. There are many resources available to service members, including free financial advisors, as well as banks and credit unions. Your family support center or grassroots readiness center can provide you with financial resources, as well as information about low-cost or interest-free loans available at your branch or aid society that you can use in a crisis. If you're not sure where to start, you can talk to a financial advisor who is available 24 hours a day through Military OneSource at 800-342-9647. If you make international calls, Military OneSource offers international calling options.

Active duty military members can receive free credit reports and credit monitoring with IDnotify™. This tool reviews your credit report regularly to help you make good financial decisions, spot early signs of identity theft, and see how you can view your lender.

Military & Veteran Student Loan Forgiveness & Discharge

The purpose of this question submission tool is to provide general education about credit reporting. At

Military service relief act, military debt relief, student loan debt relief act, military spouse relief act, debt relief act, medical debt relief act, mortgage forgiveness debt relief act, cares act debt relief, military debt relief grants, debt relief act 2020, military spouse debt relief, forgiveness debt relief act

0 Comments